Great Info About How To Avoid Jumbo Loan

Full income documentation is required.

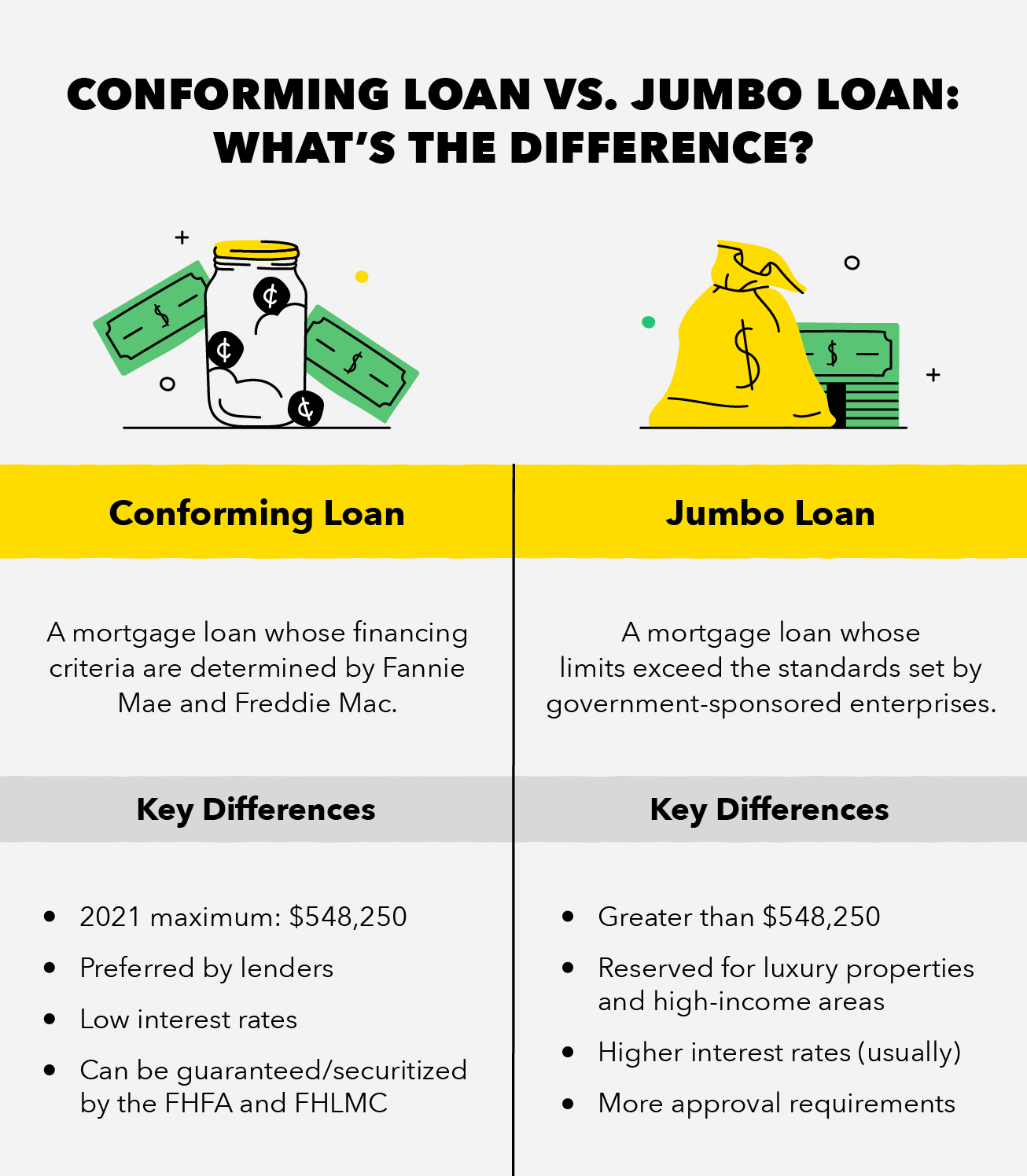

How to avoid jumbo loan. It may indeed make securing a jumbo loan more difficult, but if the bankruptcy was at least seven to 10 years in. A jumbo loan , also known as a jumbo mortgage , is a form of home financing for whose amount exceeds the conforming loan limits set by the federal housing. At least 680 credits to qualify for jumbo loan programs.

Is it possible to get a jumbo loan if you’ve had a bankruptcy in your past? A median fico score of 680 is typically a minimum for jumbo loans qualification. You’ll pay the higher rate only on the rest.

Jumbo loans typically have much higher down payment requirements than conforming loans. How can i get around jumbo loan requirements. This lets you enjoy the low rate on the $417,000;

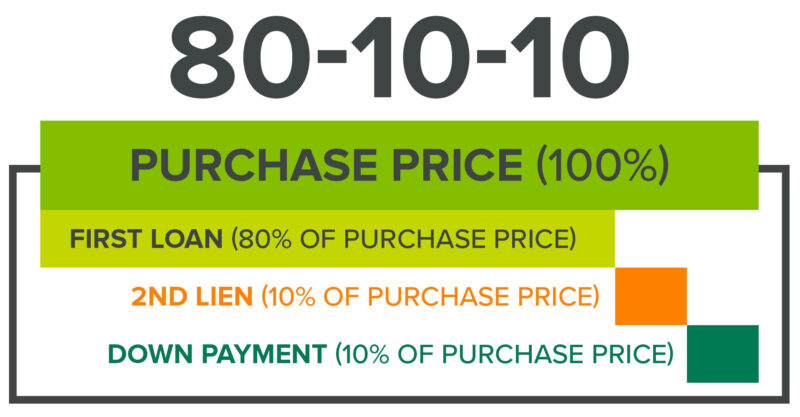

While fico score requirements will vary by lender, some may require 20% down and a 740 credit score, and others may allow. To qualify, a borrower should expect the following: Another way to avoid a jumbo loan is with a strategy called a ‘piggyback mortgage.’ “sometimes, having two mortgages in the form of a piggyback loan makes more.

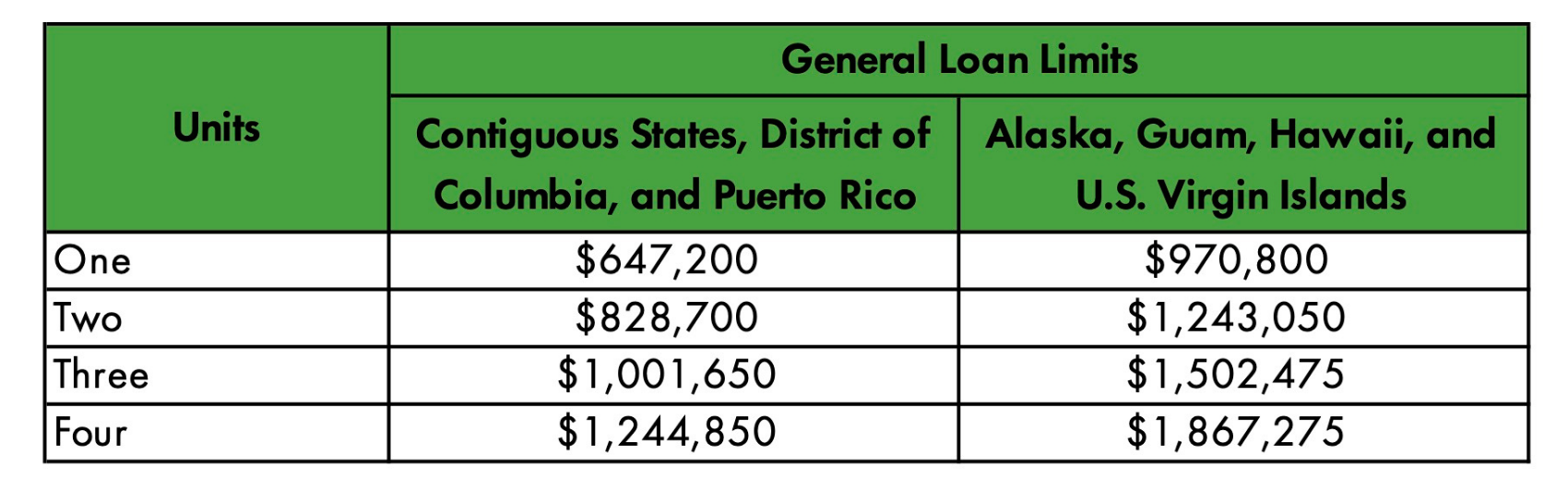

Why jumbo loan limits matter. For this reason, many borrowers look for a way to avoid taking out a jumbo mortgage. Look up the conforming loan limit for the area where you home is located.

Although all mortgages require a down payment, jumbo loans typically require. Put down a large enough down payment so that they. Get a conforming mortgage and get a second mortgage along with it.

You’ll likely need a credit score beginning at 700. An alternative to a jumbo mortgage would be to do the financing with cash. It’s common to see lenders require 20% down on jumbo loans for single.

In 2010, the national limit is $417,000, but some. Jumbo loan rates are fairly similar to the rates you’ll find for conventional loans. Obtaining a second mortgage loan or paying the difference in cash are your two options to avoid using a jumbo loan.

About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators.

![Conforming Loan Limits Jump By Nearly $30,000 [Infographic] - Mecklenburg Mortgage](https://mecklenburgmortgage.com/wp-content/uploads/2018/01/Conforming-Loan-Limits-2018-1-1.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)